Online Casinos Overtake Atlantic City Casino Floor Revenues

Atlantic City’s casino floors may be losing some of their shine. New analysis of figures from 2024 and the first two months of 2025 reveals a dip in in-person revenue across New Jersey’s iconic coastal gambling hub, while online casino revenue continues to accelerate.

The Revenue Trends

The nine remaining Atlantic City casinos reported a 1.1% decline in Gross Revenue Retention (GRR) for 2024 compared to 2023. The new year initially offered a glimmer of hope, with January 2025 showing a 3% year-over-year increase. However, that momentum did not last, with the February 2025 GRR dropping 3.8% from the same month in 2024.

Meanwhile, online casinos are heading in the opposite direction. February 2025’s iGaming revenues hit $207.8 million, a 14% jump year-on-year, and importantly, a figure that surpassed Atlantic City’s in-person revenue for the second straight month.

The Numbers at a Glance

- 2024 Atlantic City revenue: Down 1.1% vs. 2023

- January 2025 GRR: Up 3% vs. Jan 2024

- February 2025 GRR: Down 3.8% vs. Feb 2024

- In-person slots: $152.1m (down 4.3%)

- Other in-person activity: $51.3m (down 2.5%)

- Total in-person GRR (Feb 2025): $203.4m

- Total iGaming GRR (Feb 2025): $207.8m (+14% YoY)

Why the Shift?

Industry experts suggest that the decline in in-person gaming does not mean demand for gambling is falling. It is shifting. According to Jane Bokunewicz, director of Stockton University’s Lloyd D. Levenson Institute of Gaming, Hospitality, and Tourism, a quieter winter season at physical casinos “opened the door to more internet gaming activity.” She added that the momentum allowed online platforms to “outpace brick-and-mortar casinos for the second consecutive month.”

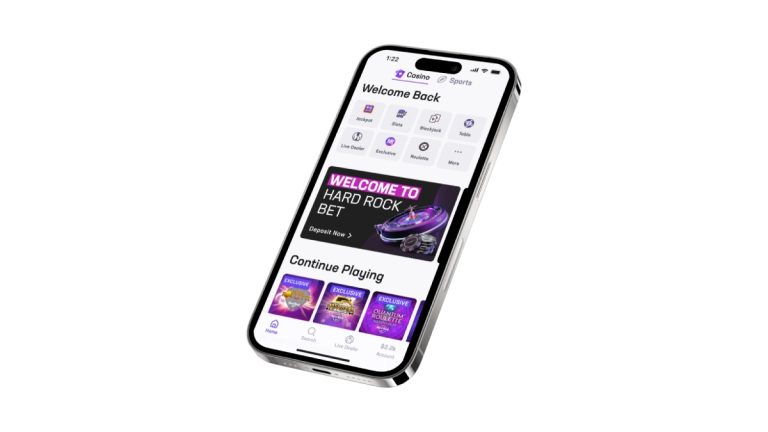

This reflects a larger trend in U.S. gaming: players are increasingly drawn to the convenience, variety, and promotions offered by iGaming platforms. Online slots, live dealer tables, and poker rooms are accessible 24/7 and provide an immersive experience without the need to travel to the Jersey Shore.

A Balancing Act for Atlantic City

For Atlantic City’s nine casinos, the challenge will be balancing the in-person entertainment experience with the growing pull of digital gambling. Seasonal factors like harsh New Jersey winters likely played a role in February’s slump, and the industry will be watching closely to see if warmer months bring a rebound in foot traffic.

That said, the broader momentum is clear: iGaming is becoming a dominant force in New Jersey’s gambling landscape. With online revenue already eclipsing brick-and-mortar performance in back-to-back months, it signals a future where digital platforms may lead the way while Atlantic City works to reinvent its in-person appeal.